Account Safety Awareness

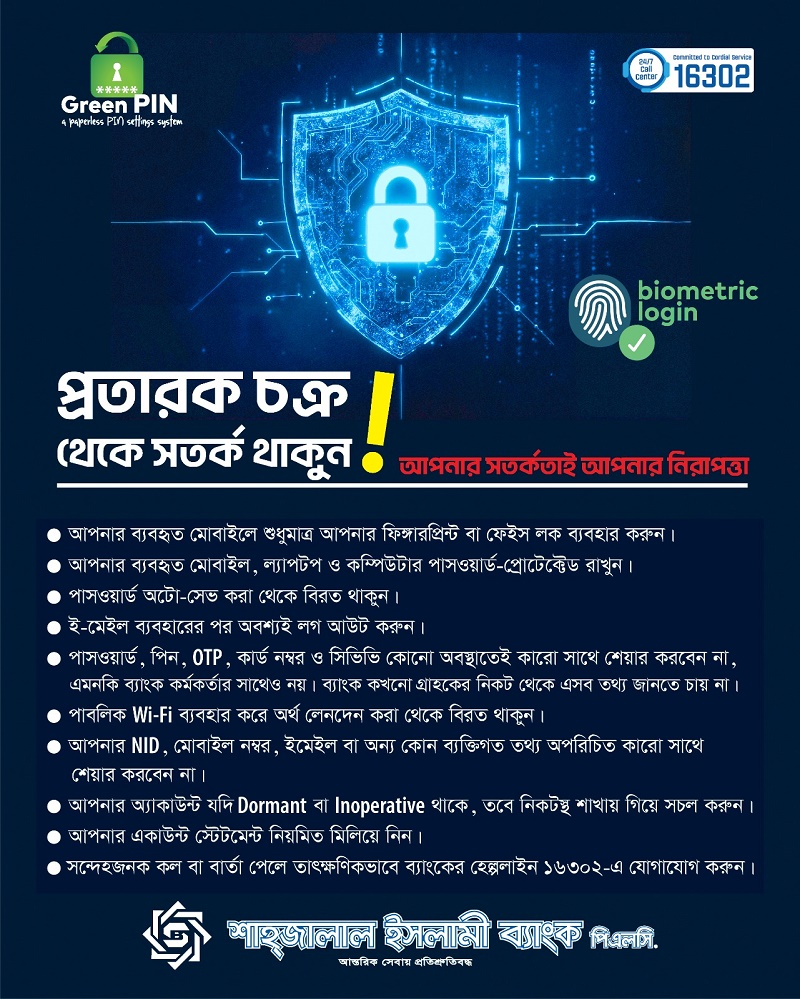

Protect Your Bank Account from Fraud and Theft

Why Account Safety Matters

Your bank account holds your hard-earned money and personal information. Keeping it secure is crucial to prevent unauthorized access, identity theft, and financial loss.

Sensitive Data Protection

Common Threats to Bank Accounts

- Phishing Scams: Fraudulent emails or messages that trick you into revealing your login details.

- Malware & Spyware: Malicious software that can steal your passwords or capture your keystrokes.

- Weak Passwords: Easily guessable or reused passwords increase the risk of account hacking.

- Unknown Wi-Fi Networks: Public Wi-Fi can expose your data to hackers if proper precautions aren't taken.

- Social Engineering: Manipulative tactics to gain sensitive information from you directly.

Security tips

- Change your password regularly and make it at least 11 digits with alpha numeric combination, special character and capital and small letter combination.

- Don't use your date of birth, telephone/mobile number or any common information as your password.

- Never disclose your password to anyone event to the employees of SJIBPLC. Never write down your password on anything.

- Never provide your confidential information like internet banking username, password in any page except the Internet Banking Login area.

- Ensure logging off from your user ID after completion of your activities.

- Avoid using internet banking form any public computer like cyber cafe.