Financial Literacy

First National Financial Inclusion Strategy (NFIS) has been developed at the verge of Fourth Industrial Revolution. This strategy has been prepared by following 5C (Commitment, Cooperation, Co-ordination, Co-existence, Comprehensive) principles of national strategy development to reach the ultimate goal of Social cohesion and stability through ensuring the scope of access and usage of quality financial services for all. In line with this, Bangladesh Bank prepared its own Financial Literacy Guidelines to promote financial inclusion through banking channel.

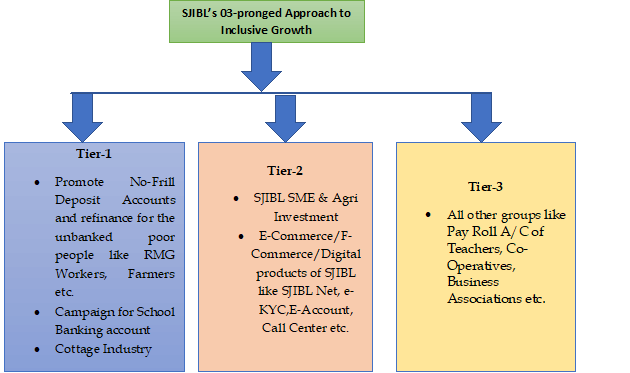

As per Financial Literacy Guidelines of Bangladesh Bank, SJIBL has been implementing Tier-1 mainly by highlighting School Banking through campaign and conference as Lead bank, Tier -2 through digital products like SJIBL Net, Online Banking, SME etc. and Tier -3 through Agent Banking. In the year 2022, number of Agent Banking stood to 111 while the bank ensured online service to all its branches since long.

In pursuance of Financial Literacy Guidelines of Bangladesh Bank, we promote following 03 tiers with a view to expanding our products and services:

The target groups of SJIBL comprise of cross-cutting community. Both the financially included and excluded populace of the target groups are covered through tier distribution. The excluded people are basically un-served or under-served segment, who are hereby expected to reap the uncovered potential of the available financial services after financial literacy. Those who are already included in the financial system are expected to keep pace with the evolution of financial ecosystem.

In the year 2022, SJIBL conducted School Banking Conference as Lead Bank in Patuakhali district which was withheld due to pandemic 02 years ago. After pandemic SJIBL was the only bank that observed School Banking Conference in Bangladesh as Lead Bank which was optional for all scheduled banks from the end of Bangladesh Bank for the year 2022. In the year 2023 we observed School Banking Conference in Coxs Bazar district as Lead Bank. In the year 2023, SJIBL implemented Financial Literacy Workshop in a garment factory (namely HA-MEEM Group) for the 1st time among garment workers in compliance with Bangladesh Bank regulations.